Two firms could have the same instructions 2020 but very different levels of risk based on their leverage, fixed costs, and other balance sheet factors. Looking at metrics like debt-to-equity along with the operating Ratio provides a more complete picture of a business. Businesses need to be careful not to over-risk or sacrifice profit margins in the pursuit of sales growth. Unprofitable growth often weighs on the stock price rather than lifting it. Companies must also ramp up capacity and resources to support bigger revenue.

Additional Resources

The intent is to determine whether the amount of operating expenses incurred or assets used is reasonable. If not, management can take steps to prune back on certain expenses or assets. The exact specifications of these ratios will vary, depending on the line items used in a company’s financial statements. All of these ratios use aggregated operating expenses, and so do not provide any insights into trends in specific expenses.

- Analysts look for ratios returning to normalized levels after initial impacts subside.

- It’s also important to compare the operating ratio with other firms in the same industry.

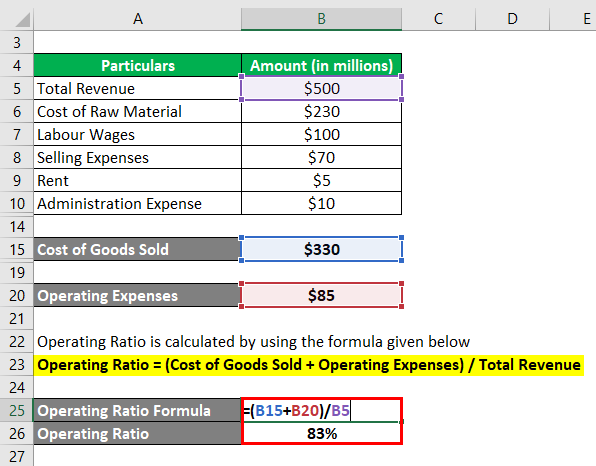

- On the other hand, the operating ratio is the comparison of a company’s total expenses compared to the revenue or net sales generated.

- Also, companies will typically not include non-operating expenses in the operating ratio.

- By calculating the operating ratio, you can determine the percentage of net sales that is being utilized to cover operational expenses.

- It is calculated by dividing operating expenses by net sales or revenue.

Financial Calculations That Reveal Your Business’s Health

Companies in different industries with wildly different business models have very different operating margins, so comparing them would be meaningless. Factor operating ratio analysis into revenue, earnings, and cash flow forecasts to assess impacts on valuation. An elevated operating ratio will directly pressure projected margins, earnings, and cash flows. Relate operating ratio trends to return on invested capital metrics to analyze the efficiency of capital allocation.

Return on Shareholders’ Investment or Net Worth

Return on sales (ROS) is a profitability ratio which reflects how efficient an organization is in utilizing its total assets to generate revenues. Since ROS also takes into account the total assets, it provides a more complete picture of the company’s overall efficiency. A return on assets shows how efficiently a company uses its assets to generate profits. It indicates the profitability of a company’s assets relative to their cost.

Receivables Turnover

Investors must monitor costs to see if they’re increasing or decreasing over time while also comparing those results to the performance of revenue and profit. The operating Ratio has direct implications for free cash flow generation, which is a vital consideration in equity valuation. Since excess operating costs squeeze operating income, they reduce the free cash flow available to fund growth investments and returns to shareholders. A higher operating ratio, therefore, signals lower cash generation capacity, impacting valuation.

This resulted in an operating ratio of 89.98% for FY23, which marginally improved from 91.01% in FY21 and 89.04% in FY22. Though the operating Ratio remains high, the slight reduction indicates Tata Motors’ continued efforts to manage costs effectively despite significant increases in both revenue and expenses. Analysts often monitor operational ratios as a helpful indicator of productivity, profitability drivers, and management execution when assessing a company’s financial performance. Investors should monitor a company’s costs for changes while also reviewing these results against profit and revenue.

A growth-oriented business frequently experiences this when it makes a significant upfront investment in additional stores, factories, machinery, or other assets to support growth. The expansion weighs on short-term profitability as operating expenses swell before the growth initiatives have had time to boost revenue. Once the expansion starts yielding returns, the operating Ratio should moderate. For investors, an elevated operating ratio due to growth investment is acceptable if the company has a solid long-term plan. The operating Ratio is calculated by dividing a company’s operating expenses by its net sales or revenue over a specified time period. Trends in operating ratio factor into valuation models like discounted cash flow analysis.

Expectations for future stock performance are based on previous trends and predicted changes since the operating Ratio affects profitability, efficiency, and management perception. An improving ratio outlook supports a bullish stock view, while a deteriorating outlook translates to weaker expectations. Any investor looking to buy a stake in a company would do well to consider its operating ratio. However, it should be viewed with caution because most companies do not include debts in the calculation of the ratio. A current ratio of 1.5 or higher is generally considered a good indicator of liquidity. It shows that the company has sufficient current assets to cover its short-term obligations.

Volume growth requires attracting new customers and getting existing customers to buy more. Raising prices works best when the company has pricing power due to strong branding, product differentiation, or market positioning. A constant operating ratio means this metric persists at roughly the same level year after year rather than fluctuating widely. Some variation is normal, but a steady trend signifies that the efficiency of the company’s operating model is not dramatically changing. A continuously low and rising operational ratio is preferred when assessing businesses for investment.

They also compare ratios to industry benchmarks to assess relative efficiency. A consistently low or declining operating ratio signals a company is becoming more profitable through improved cost management. This article will explore how the operating Ratio is calculated and analyzed and what it reveals about a company’s financial performance. The operating margin measures how much profit a company makes on a dollar of sales after paying for variable costs of production, such as wages and raw materials, but before paying interest or tax. It is calculated by dividing a company’s operating income by its net sales. Higher ratios are generally better, illustrating the company is efficient in its operations and is good at turning sales into profits.