The balances on the assets side must always be equal to those on the liability and owner’s equity side. The cash flow statement shows the inflow and outflow of money within a business, usually broken into operating, investing, and financing activities. Download our free payroll checklist template to improve your team’s accuracy and efficiency. You can also use flowcharts to track client work to know how much work is left to complete the process. Start best way to crowdfund a nonprofit a 14-day free trial today to see why over 6,000 accountants and bookkeepers use Jetpack Workflow as their practice management and automation system.

Standardize Their Processes

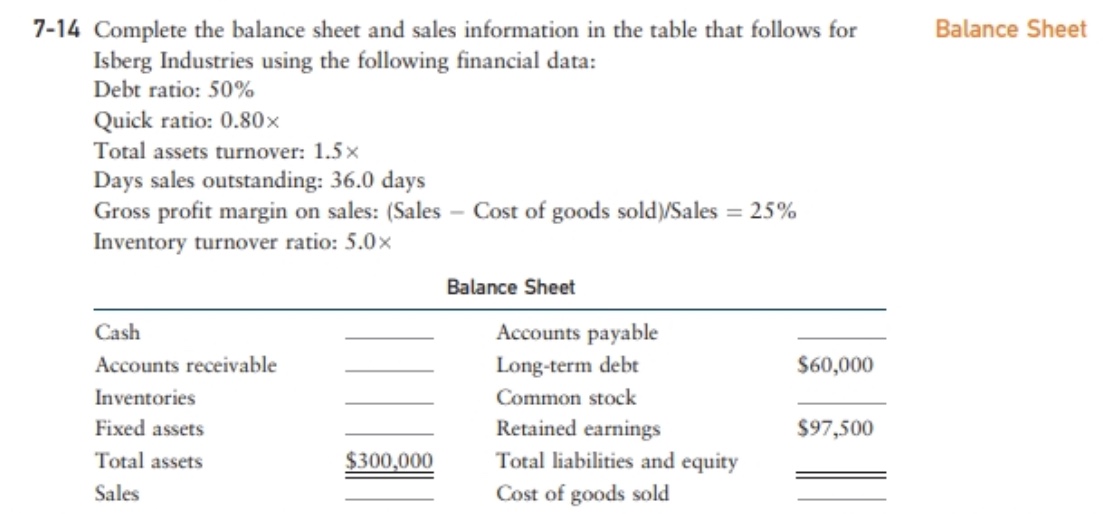

The template keeps a running subtotal of expenses, adjusting the total sum with each new entry. Use this balance sheet template to report your business assets, liabilities, and equity. The template calculates common financial ratios, such as working capital and debt-to-equity ratio. Edit the example line items to list all of your current and long-term assets and liabilities, and view subtotals for each section and column. All the work your firm does has rules that define how to complete the work to your firm’s standard.

- Bookkeeping templates are documents that help you track and manage financial data and business performance.

- Jetpack Workflow was built with bookkeepers and accountants in mind and contains predefined templates to help you avoid these issues.

- It is hard for your team to know the best and most efficient way to complete client work, especially when it is all in your head due to years of experience.

- We enjoy ensuring that the bank is reconciled (who hasn’t delighted in reaching $0 variance when completing a tough reconciliation?).

- Download our free payroll checklist template to improve your team’s accuracy and efficiency.

- The template provides space to add notes or detailed descriptions as needed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. When you don’t have a clear process for your staff to follow they will make many mistakes. These mistakes will require you to waste time fixing the mistakes over and over again. Jetpack Workflow offers a free 14-day trial because they’re confident that within two weeks you’ll be convinced, and you’ll see how simple it is to streamline your practice management. You now have the option to schedule the next iteration of the project if it’s a recurring task or to reach out to your client to see if they need other services.

Fewer interruptions lead to what is a secured credit card more efficient work and add to your bottom line. These items are added back or subtracted from the closing balance for the period in the bank statement during the reconciliation process. The process allows you to identify and resolve issues quickly and reduce the chance of fraudulent activities. This sheet shows the company’s financial position or net worth based on what it owns (assets) vs. what it owes (liabilities and owner’s equity) during any given period.

Accounts Receivable Template

Bank reconciliation in bookkeeping refers to reconciling the balances between a company’s bank account statement and the bank account ledger. While the closing balances should be equal, sometimes there are variances. A well-designed flowchart shows how to handle outstanding checks in payroll the overall process from start to finish, but the process symbol shows the specific tasks in the larger accounting process.

This template was created by Ian Vacin from Karbon (with support from Hubdoc and top cloud accounting practices). Having automatic reminders set for upcoming tasks allows you to free up your mental capacity for the work itself. Or use it in Financial Cents to organize your workflows and manage your team. The decision points steps of your flowcharts are represented by a rhombus. It indicates the points in your process where the outcome of a decision determines the direction of the next step. The most common outcomes of the decision stage are Yes and No, although it can be more.

Register to start a 14-day trial

Month end close process is more accurate when you use a checklist template to streamline the process. You will need to write the step the symbol links to (within the symbol) so that your team knows which step to look for in the referenced flowchart. Flowcharts help to tell your team what they need to know to move your projects from start to finish. Ultimately, the best workflow template to use is the one that you and your team will stick to. Tax season is tough enough without having to wonder what’s next on your project or wondering if your team is making progress.

There are any number of reasons that you end up circling back to the client before finishing the accounting work on the project. It serves as a roadmap for organizing and recording all financial data, such as income, expenses, assets, and liabilities. The template typically includes numerical codes assigned to each account to ensure consistency in record-keeping. Here are some examples of accounting flowcharts that you can create with your workflow checklists to ensure your accounting and bookkeeping projects don’t fail.

Common Processes and Procedures to Consider as You’re Building Out Your Workflow

The template lists example cash receipts, payments, operating expenses, and additional costs. Use this template to review each item and determine the overall month-end cash position for each time period. This template includes a ledger for tracking customer payments and an accounts receivable aging tab to track outstanding payments. The template automatically populates the accounts receivable aging sheet after you fill in the payment ledger. Add invoice terms, amounts, and payments received to view current and overdue balances.

Enter the starting date for the week at the top of the template, and the dates will automatically populate the timesheet. This template allows you to track the variance between your projected and actual cash position for each month and calculates total cash payments and net cash change. By standardizing your workflow processes, you won’t have to spend weeks training your staff members and answering them because all that knowledge will be in the bookkeeping templates.